Roth Conversion: For You? Or For the Next Generation?

A partner of mine recently stopped by my office to discuss Roth conversions. I may have preferred to talk about the Tour de France, but he was purpose driven to discuss Roth conversions.

During our discussion he identified a scenario that may apply to higher income individuals who, because of high marginal tax rates, are making or have made traditional pre-tax 401(k) deferrals during their working careers, but have eschewed Roth deferrals. He postulated the case of an individual, who after reaching age 67, retires and won’t be subject to (and does not want to take) required minimum distributions until age 73.

For the convenience of example, assume no other taxable income and ignore any state tax. If the individual converts $100,000, the federal tax (using 2023 rates) would be $14,260. Further assume that the individual uses other assets to pay the income tax. Let’s also assume $100,000 is converted each year for 5 consecutive years and the investments return 5% compounded annually so that when the individual is 73 years old, the Roth balance is $580,000.

Roth conversion calculators are helpful tools but, just like this example, have to make certain assumptions. One is that the converted Roth account will be distributed and the models base the conversion decision on current tax rate and conversion cost, projected future tax rate and the number of years before distributions will begin. Applying the information inserted to the program, a given model predicts whether a conversion will result in more or less money after taxes and when distributions commence.

However, what if the individual considering a Roth conversion is motivated not by the extra money that may be available for distribution during the account owner’s lifetime, but by the income tax-free advantage that may be available to the beneficiary?

In the example above, our generous planner would have $580,000 in the Roth and would have paid $71,300 in federal taxes; or would have $580,000 in a traditional account at age 73. If the funds sit in a Roth account, when the owner attains age 73, no RMDs are required. After 10 years at 5% compound annual earnings, the Roth account has a value of approximately $944,750.

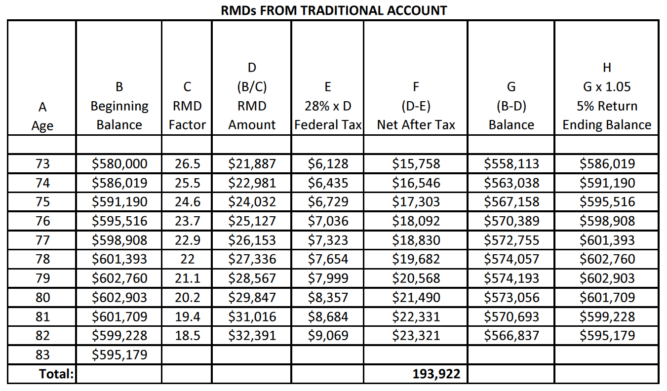

If the owner did not make the conversion and commenced only RMD distributions at the beginning of each year upon attaining age 73, the estimated traditional account balance at age 83 would be $595,179.

See the following table for the calculations.

*Estimated based on 5% compound earnings and without adjusting for taxes on the earnings.

So how do the two approaches compare?

This example anticipates that the Roth conversion tax cost will be paid from funds outside the plan so as to maximize the Roth conversion. It uses a 5% compound annual return and as the financial markets have recently reminded us, nothing in this regard is certain. It also anticipates that the net after-tax distribution from the traditional account will be saved and reinvested. That assumption is likely optimistic. For a comparison at a moment in time when the account owner is age 83, the example calculates the federal tax on the entire account balance rather than continued deferral during the beneficiary’s permitted 10-year withdrawal period.

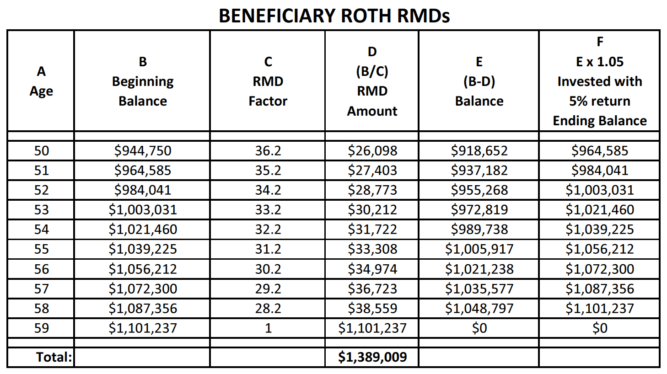

From a planning perspective, if you have made it to 83 and are the owner of the account who has made the Roth conversion, good for you! Keep going. You have approximately $944,000 available to you on a federal income tax-free basis, if you need or want to use it. If you do not need or want to apply it, subject to investment results, it should continue to appreciate until your death. At that time, distributions would commence and be made over 10 years. The minimum distributions required for your beneficiaries would likely allow the fund to continue to grow until the final distribution at the end of the 10-year distribution period. The following table is an example of the potential further accumulation of federal income tax free Roth funds during and up to the expiration of the beneficiary’s 10-year distribution period. The example assumes the beneficiary is 50 years old at the time of the owner’s death.

In this hypothetical, the beneficiary ultimately receives $1,389,009 free from federal income tax from the original $500,000 Roth conversion.

For demonstration purposes this may be an extreme example. However, it did get your attention and hopefully, will trigger your interest to consider a Roth conversion as part of your overall estate planning.

By the way, it also satisfied my partner’s curiosity. Now, what happened in the Tour today?

Reach out to your estate planning attorney, or Dave Mosier, for more information or to review your estate plan details.

Legal Advice Disclaimer:

The content of this website is provided for general information purposes only. It should not be used as a substitute for consulting an attorney for legal advice regarding the reader's own affairs. Knox McLaughlin Gornall & Sennett, P.C. is not responsible for the content provided on any third-party website which may be accessed via links provided by this site.

Copyright © Knox McLaughlin Gornall & Sennett, P.C.

Not to be reproduced without permission.